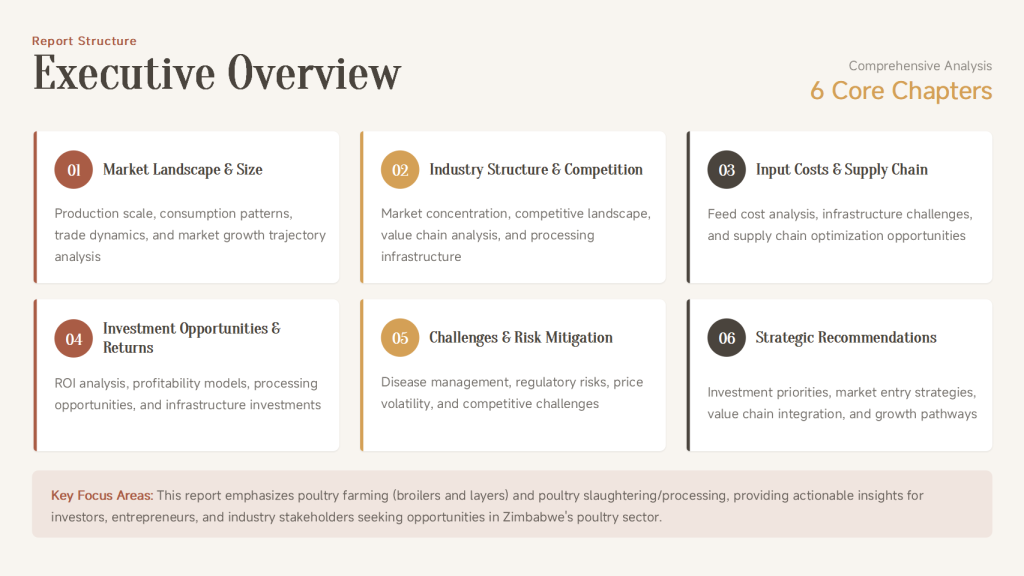

Market Opportunity Analysis Report for Zimbabwe’s Livestock and Poultry Farming and Slaughtering Industry

1. Executive Summary: A Regional Livestock Powerhouse in Recovery

The livestock and poultry farming and slaughtering industries in Zimbabwe are at a historic inflection point of recovery and strategic restructuring. The government’s ambitious Livestock Growth Plan (LGP) aims to build a USD 2 billion livestock-based economy and regards it as a key pillar for achieving the national “Vision 2030” development strategy. Within this framework, the poultry (broiler) industry, as the fastest and most efficient means of providing animal protein, and the beef cattle industry, which urgently needs revitalization, together form the dual engines driving growth. The former targets the vast domestic import substitution market, while the latter aims for high-value exports. Both face comprehensive modernization demands from production to processing.

Core Conclusion: The opportunities in the Zimbabwean market are rooted in the huge gap between its substantial resource base and its inefficient industry chain. For investors, this creates a full-chain investment window from upstream inputs (feed, breeding stock), midstream modern farming and compliant slaughter, to downstream branding and market channels. The key to success lies in building an operational system featuring vertical integration or strong value chain synergy to systematically address core challenges such as diseases, cost volatility, and weak infrastructure.

2. Market Overview and Macro Environment

2.1 Economic Status and Strategic Vision

Agriculture is the cornerstone of Zimbabwe’s economy. The government plans to increase the total agricultural output value by 53%, from USD 10.3 billion in 2024/25 to USD 15.8 billion by 2030/31. Livestock has been explicitly identified as a core driver of this growth.

2.2 Policy and Investment Framework

- Core Strategy: The Livestock Growth Plan (LGP) serves as the action plan for this sector.

- Institutional Driver: The Zimbabwe Investment and Development Agency (ZIDA) is actively promoting several large-scale agro-industrial projects.

- International Support: Institutions like the EU and the UN Food and Agriculture Organization (FAO) provide funding and technical support.

3. Analysis of Market Segment Opportunities

3.1 Beef Cattle Farming and Fattening: Reviving Export Prowess

The most prominent current market opportunity lies in bridging the rigid supply gap for beef and reviving exports.

| Opportunity Dimension | Detailed Analysis |

|---|---|

| Market Gap & Potential | There is a 25%-40% supply gap for beef domestically. The industry assesses a potential to export 15,000 tonnes of beef annually to the Middle East market, with the long-term goal of resuming high-value exports to the EU. |

| Core Bottlenecks | Feedlot capacity utilization is only one-third; slaughter facilities are outdated, lacking internationally compliant processing capacity. |

| Investment Entry Points | 1. Modern, large-scale feedlots: Improve finishing efficiency. 2. Export-oriented industrial slaughterhouses: Build facilities meeting EU/Middle East standards. 3. High-quality breeding stock cultivation: Improve genetic foundations. |

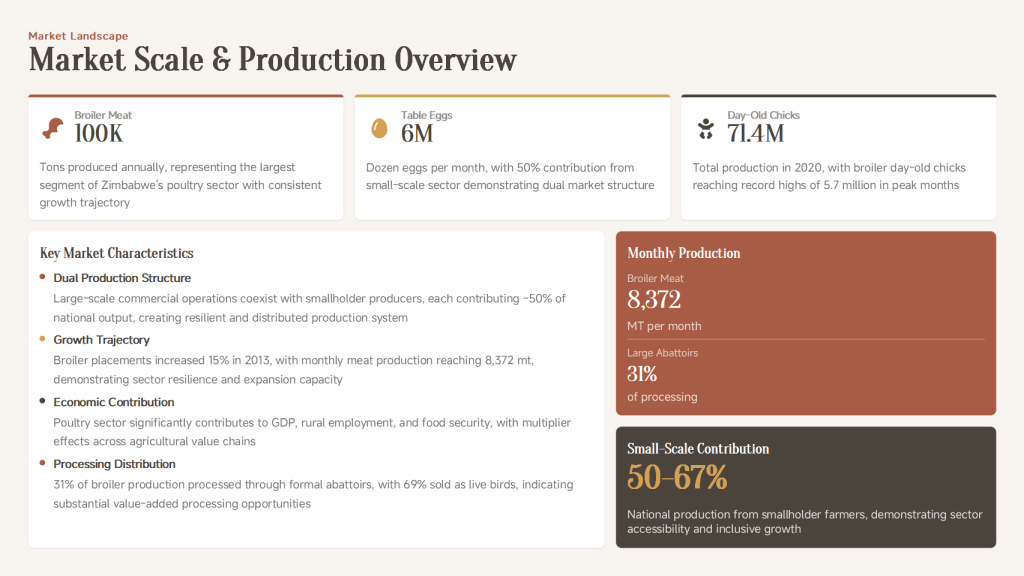

3.2 Poultry (Broiler) Farming and Processing: The Main Battlefield for Import Substitution

The poultry industry is the most direct and fastest-growing sector for meeting domestic protein demand but faces intense competition and cost pressures.

| Opportunity Dimension | Detailed Analysis |

|---|---|

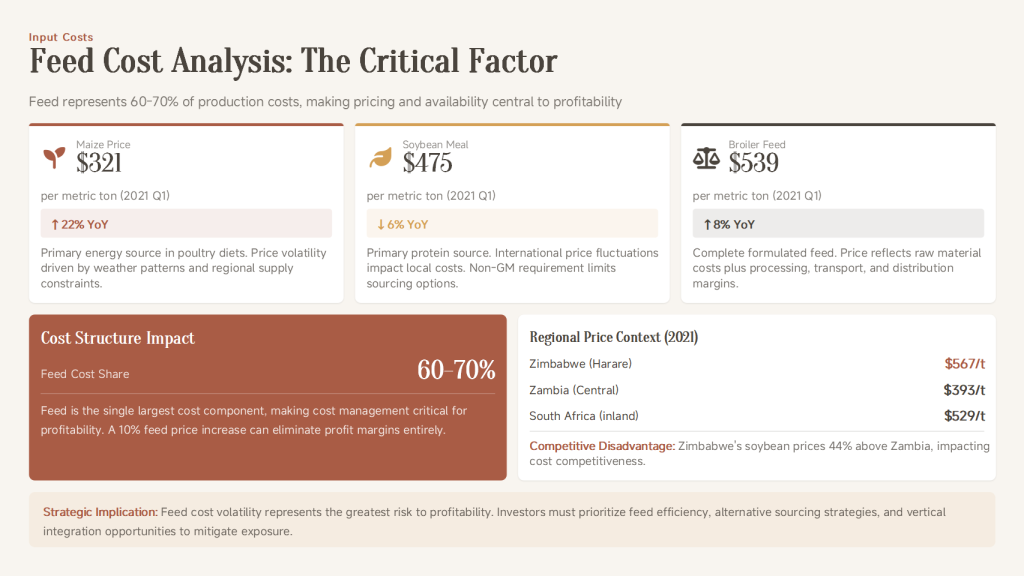

| Market Position | Poultry is the most consumed meat in Zimbabwe, but domestic production is often constrained by high input costs (especially feed). |

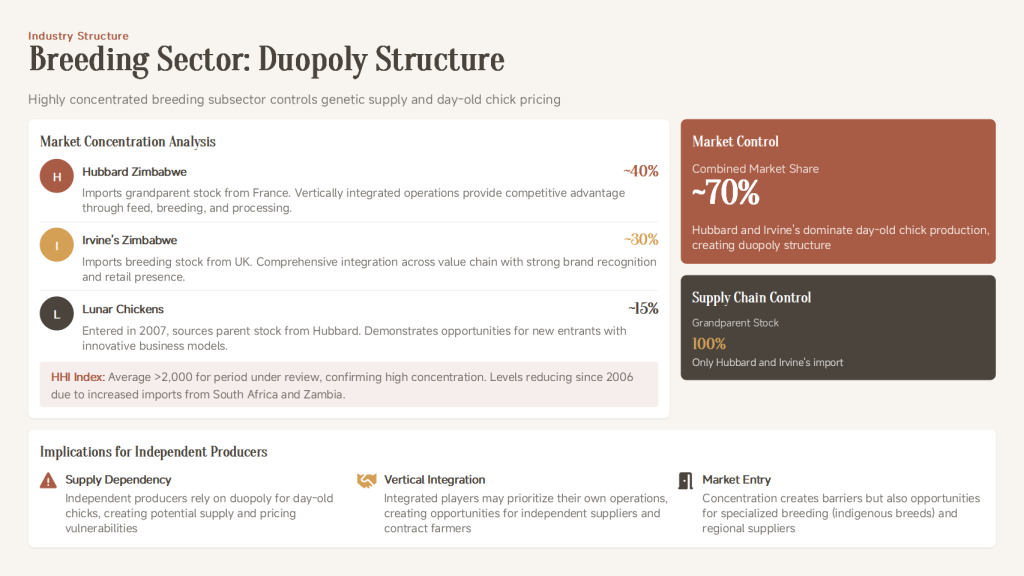

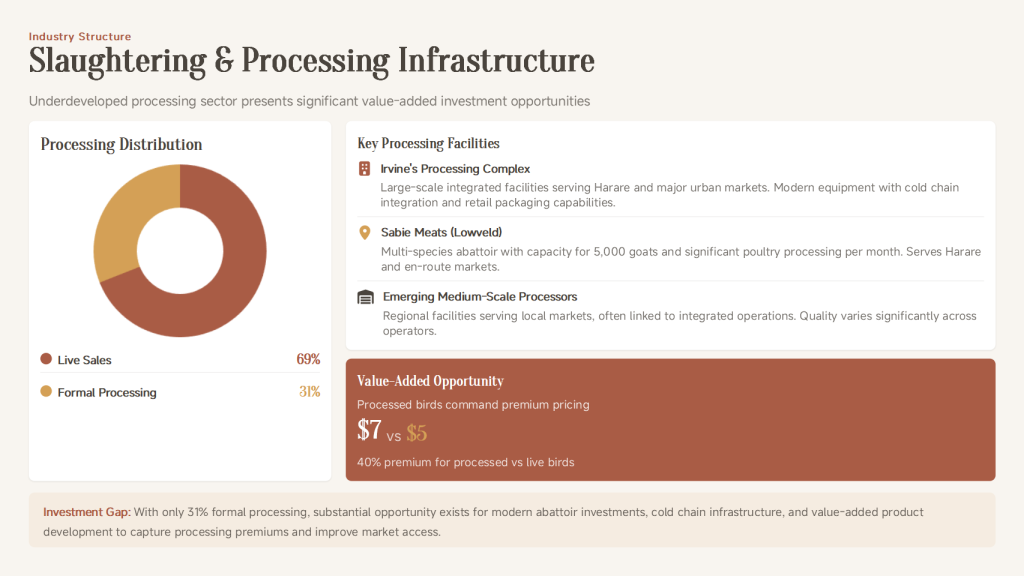

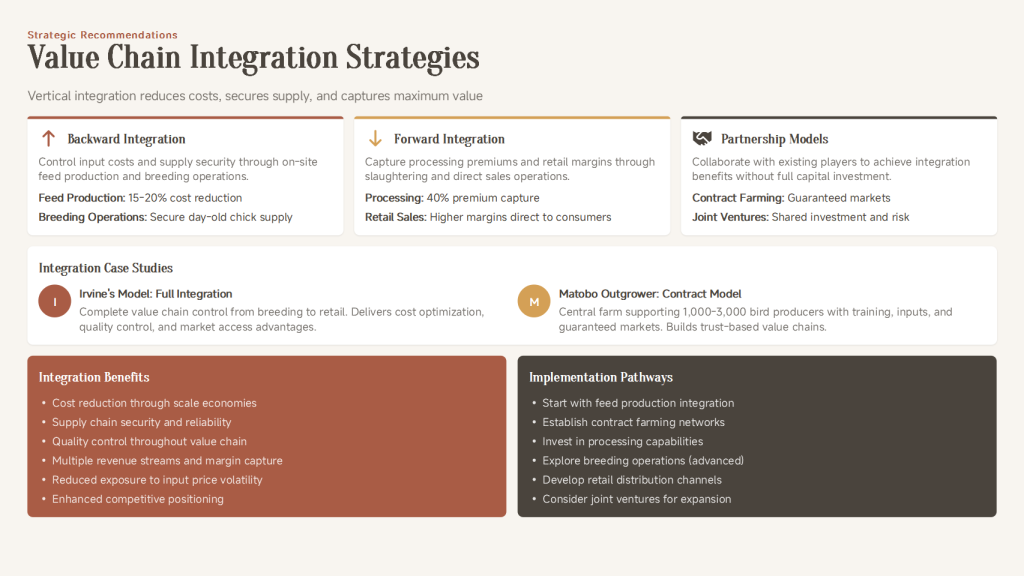

| Core Challenges | 1. Feed costs: Maize and soybean costs account for about 70% of production costs, and their price volatility directly affects industry profitability. 2. Foreign currency shortages: Difficulties in importing key equipment, pharmaceuticals, and genetic materials. 3. Disease pressure: Threats like avian influenza jeopardize production stability. 4. Market competition: The market is dominated by a few large, vertically integrated companies, creating high barriers for new entrants. |

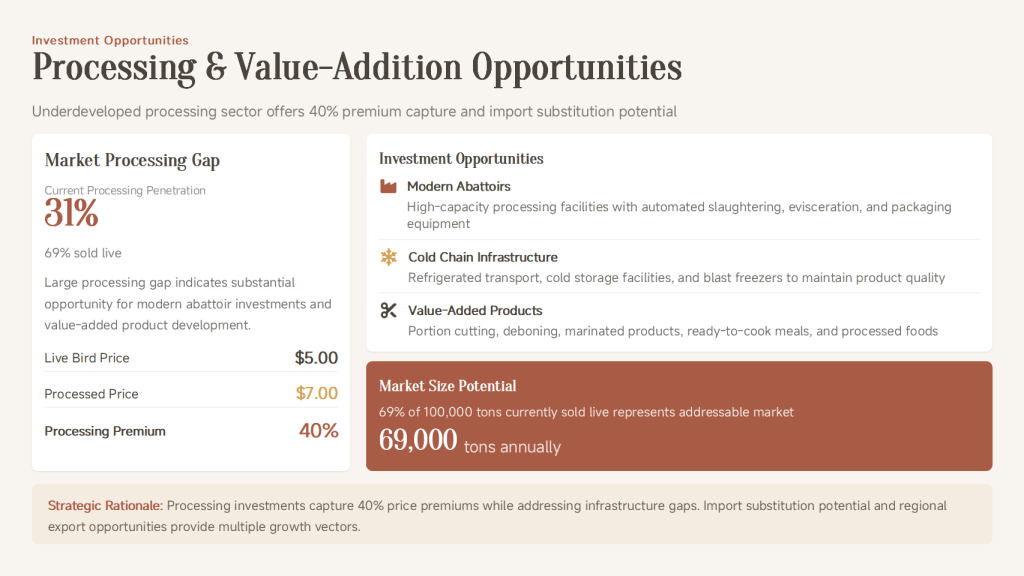

| Key Opportunities | 1. Sustained demand growth: Driven by population growth and urbanization. 2. Import substitution potential: Although local production is dominant, there is still room to substitute potential imports after improving production efficiency and reducing costs. 3. Value chain segmentation opportunities: Full-line competition isn’t necessary; entry is possible in segments like parent stock/hatching, specialized feed production, contract farming, or slaughtering/processing for specific markets. |

| Investment Entry Points | 1. Feed solutions: Investing in drought-tolerant feed crop cultivation or alternative protein feed ingredient production is a strategic move to control the industry’s lifeline. 2. Modern farming facilities: Building environmentally controlled poultry houses to enhance biosecurity and farming efficiency. 3. Efficient slaughtering/processing plants: Investing in highly automated, hygienic standard-compliant processing plants capable of value-added cutting to serve regional markets. |

3.3 Key Supporting Industries: Animal Health and Feed

The stable development of the industry is highly dependent on improvements in these two fundamental supporting areas, crucial for both cattle and poultry.

| Sub-sector | Market Pain Points & Opportunities |

|---|---|

| Animal Health Management | Disease is one of the biggest risks (Foot-and-Mouth Disease, tick-borne diseases, Avian Influenza). This creates huge demand for professional veterinary services, vaccine and veterinary drug supply, and disinfection/epidemic prevention facilities. |

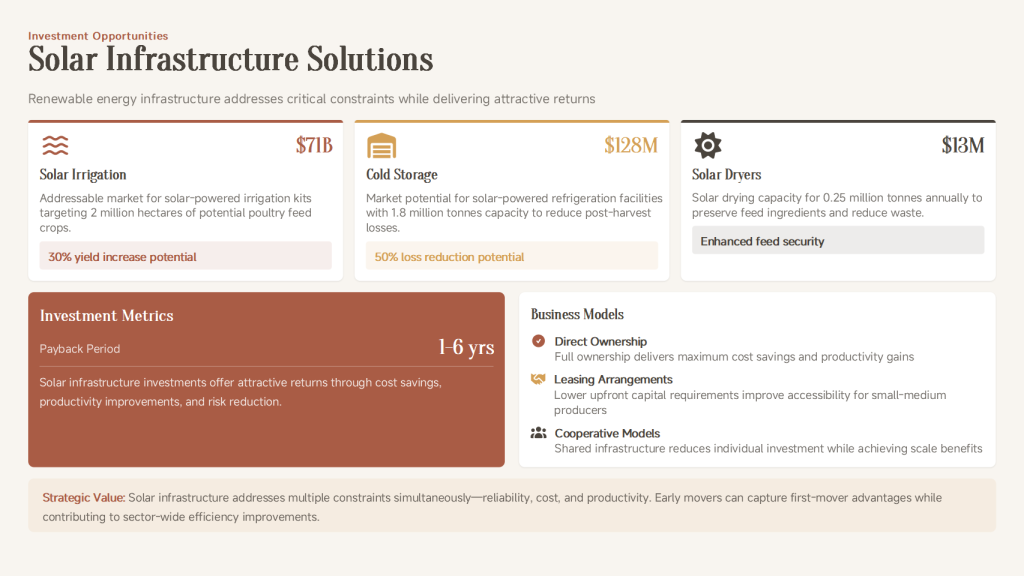

| Feed Industry | Cyclical drought is the core threat. Investing in drought-tolerant feed crop cultivation, industrial feed processing, silage production, and feed reserve systems offers broad market prospects and is a prerequisite for ensuring the success of any farming project. |

4. Key Risks and Challenges

| Risk Category | Specific Challenges & Mitigation Reference |

|---|---|

| Production Risks | Threats from animal diseases; cyclical severe droughts. Mitigation: Incorporate disease prevention/control and drought-resistant resources into core operational costs and purchase relevant insurance. |

| Economic Risks | High and volatile input costs (especially feed); high local financing costs; volatile forex policies. Mitigation: Seek cooperation with ZIDA to attract international investment; explore vertical integration to control costs; use tools like futures to hedge price risks. |

| Infrastructure Risks | Unstable power supply; insufficient cold chain logistics. Mitigation: Locate projects in areas or Special Economic Zones with relatively sound infrastructure; build backup power generation and primary cold chain systems. |

| Policy & Market Risks | Potentially complex procedures; highly concentrated poultry market. Mitigation: Partner with local professional institutions to ensure compliance; adopt differentiated or value-chain synergy strategies for market entry. |

5. Strategic Recommendations and Entry Pathways

5.1 Cooperation and Business Model Recommendations

- Synergy with Government & Development Agencies: Engage closely with ZIDA and participate in its planned flagship projects to enjoy policy conveniences.

- Joint Venture Model for Beef Industry: Form joint ventures with local large farms or cooperatives possessing land and herds but lacking capital and technology.

- Differentiated Entry for Poultry Industry: Avoid head-on competition with existing giants. Options include: Becoming a specialized feed supplier; partnering with large enterprises or retailers for contract farming; investing in efficient slaughter/processing plants in specific regions to provide toll processing services.

- Vertical Integration Model (Recommended for Large Investments): Establish a vertically integrated system from feed production and scale farming to modern slaughtering and cold chain distribution to maximize control over costs, quality, and risks.

5.2 Phased Implementation Pathway

| Phase | Objectives | Key Actions (Can be parallel or selective) |

|---|---|---|

| Phase 1: Pilot & Anchoring (1-2 years) | Establish demonstration projects, validate business models, gain trust. | Beef Pathway: Conduct pilot fattening through cooperation; initiate export certification. Poultry Pathway: Invest in pilot feed processing or sign contract farming agreements; research regional slaughter/processing demand. |

| Phase 2: Scaling & Core Asset Construction (3-5 years) | Expand scale, build core processing facilities, form brands. | Beef Pathway: Build new feedlots and supporting feed mills; invest in export-standard slaughterhouses. Poultry Pathway: Expand feed production capacity; build modern farms or regional slaughter/processing centers. |

| Phase 3: Industry Chain Refinement & Market Breakthrough (5+ years) | Become an industry leader, achieve stable exports/market share. | Beef Pathway: Achieve stable exports; expand by-product processing. Poultry Pathway: Deepen value chain integration; establish strong regional brands. |

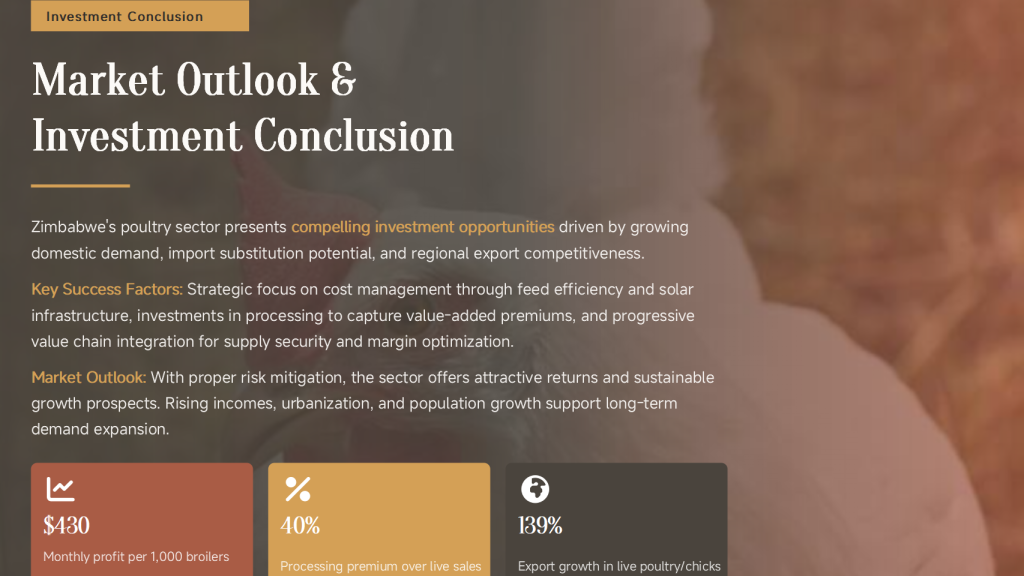

6. Conclusion

Zimbabwe’s livestock and poultry farming and slaughtering industries exhibit characteristics of “high risk, high potential.” The opportunities stem from the systematic reconstruction of a fundamentally strong industry driven by rigid demand and national will.

For the beef industry, investors act as “value activators,” transforming potential herd resources into high-value commodities meeting international standards through capital and technology. For the poultry industry, investors need to become “efficiency innovators” or “value chain strengtheners,” succeeding within the existing market structure by enhancing efficiency, reducing costs, or filling specific segment gaps.

Regardless of the chosen track, investors who can adopt a long-term perspective, deeply engage locally, and build risk-resistant, integrated business models are most likely to achieve above-average returns on this vast livestock plateau awaiting recovery.