This is a strategic-level business analysis report targeting international investors, decision-makers of agricultural enterprises, development organizations, and policymakers. The report will be presented in Chinese, with a focus on objective data, in-depth insights, and actionable recommendations.

Cover PageFrontier Investment Opportunities in Agriculture and Animal Husbandry in West Africa

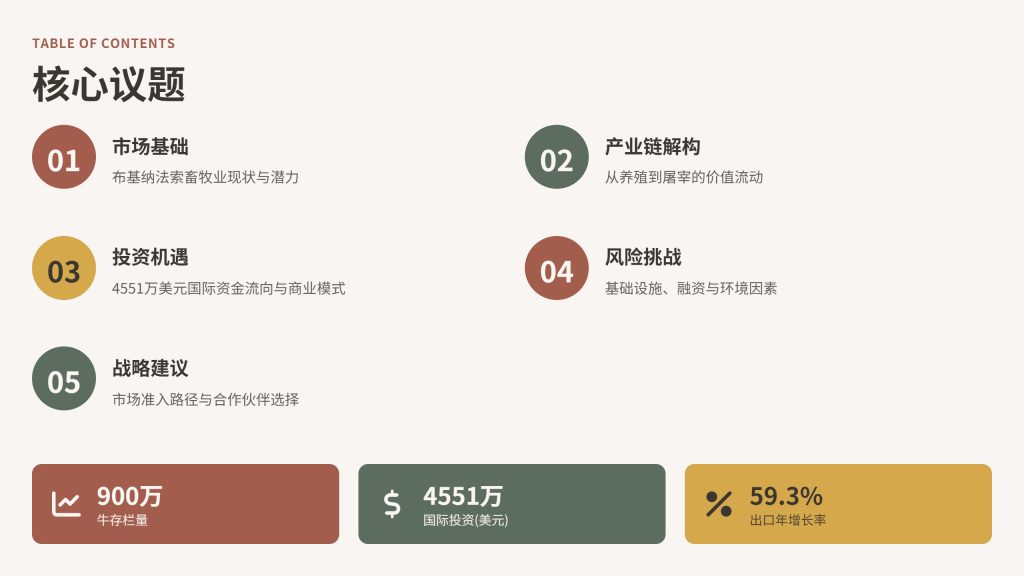

01 Market Foundation: Current Status and Potential of Animal Husbandry in Burkina Faso02 Industrial Chain Deconstruction: Value Flow from Breeding to Slaughtering03 Investment Opportunities: USD 45.51 Million International Capital Flow and Business Models04 Risks and Challenges: Infrastructure, Financing and Environmental Factors05 Strategic Recommendations: Market Access Paths and Partner Selection

01 Market Foundation

Current Status and Potential of Animal Husbandry in Burkina Faso

Country Overview: A Hub of Agriculture and Animal Husbandry in West Africa

This section introduces Burkina Faso’s geographical location, population structure (22 million people, 65% under the age of 25), economic status (a member of the Economic Community of West African States, radiating a consumer market of 400 million people), and the core status of agriculture in the national economy (accounting for 18% of GDP and employing 900,000 people). It also demonstrates its strategic location advantage as a landlocked country and the convenience of connecting to the European market brought by the French-speaking environment.

Scale of Animal Husbandry: An Industrial Foundation with 9 Million Cattle

This section presents detailed scale data of Burkina Faso’s animal husbandry: 9 million cattle, the stock of small ruminants, the distribution of 45 major livestock markets (69% production markets, 18% export markets), and seasonal sales patterns (low season from February to May, peak season from December to January). Data visualization is used to show the proportion of animal husbandry in the national economy (18% of GDP) and its comparative relationship with the cotton industry.

Market Potential: Dual Driving Forces of Domestic Demand and Export

This section analyzes the two major engines of market demand: On the domestic demand side, the growth of meat consumption among 22 million people and the expansion of the middle class in West Africa drive the per capita meat consumption (annual growth of 2% for pork and 1.6% for mutton); on the export side, the export of live animals increased from 581 tons to 3,746 tons from 2019 to 2023, with an average annual growth rate of 59.3%. The main export destinations include Ghana (accounting for 49% of sheep exports and 83% of goat exports), Benin, Togo and Côte d’Ivoire. The stock is expected to exceed 10 million heads in 2026.

02 Industrial Chain Deconstruction

Value Flow from Breeding to Slaughtering

Current Status of the Value Chain: From Live Animal Export to Meat Processing

This section deconstructs the current industrial chain structure: production end (rural farmers, nomads), collection end (31 production markets, 4 assembly markets), slaughtering end (the main slaughterhouse in Ouagadougou processes 57% of cattle), and trade end (18% export markets, 4% consumer markets). It reveals the core pain points of the value chain: excessive proportion of live animal exports, insufficient domestic slaughtering capacity, lack of deep processing capabilities, and excessive intermediate links leading to low prices for farmers and high terminal prices.

Market System: Hierarchical Distribution of 45 Livestock Markets

This section conducts a detailed analysis of the classification and operational characteristics of 45 livestock markets: production markets (31, accounting for 69%, supply side), assembly markets (4, accounting for 9%, bulk integration), export markets (8, accounting for 18%, cross-border trade), and consumer markets (2, accounting for 4%, urban terminal). It shows the market sales frequency (47% once a week, 44% once every three days), seasonal fluctuations (low season from February to May, peak season from December to January), and the annual trading volume of small ruminants (513,000 heads).

Competitive Landscape: From Regional Trade to International Suppliers

This section analyzes the competitive situation: at the regional level, Burkina Faso is a major supplier of live animals in West Africa, competing with Mali and Niger, and exporting to coastal countries such as Ghana and Côte d’Ivoire; at the international level, it faces competition from meat exporting countries such as Brazil, India and the United States, as well as the leading position of halal meat suppliers from Australia and New Zealand in the Middle East and North African markets. The study points out that cattle from Burkina Faso account for about 1/3 of Ghana’s beef consumption, but 77% of beef imports are low-value products such as offal.

03 Investment Opportunities

USD 45.51 Million International Capital Flow and Business Models

International Investment: USD 45.51 Million to Boost Industrial Chain Upgrading

This section presents the layout of international capital in detail: the African Development Bank’s USD 45.51 million project (Bobo-Dioulasso modern slaughterhouse and meat processing plant, benefiting 30,000 farmers and creating 4,000 jobs), the World Bank IDA’s USD 200 million agricultural loan, the IDA’s USD 37.5 million Sahel Animal Husbandry Support Project Phase II, and the government’s USD 2.3 million Ziniaré slaughterhouse construction project. It shows the capital allocation: modernization of the production end, standardization of the processing end, and internationalization of the market end.

Business Models: From Slaughtering and Processing to Branded Meat Products

This section constructs three major business models: slaughtering and processing model (modern slaughterhouses, cold chain logistics, cutting and packaging, targeting the domestic urban market), export-oriented model (halal certification, export of high-value meat cuts to the Middle East/North Africa, export of by-products such as offal to coastal countries in West Africa), and branded meat model (chilled meat brands, western fast food supply chains, supermarket channels). It analyzes the profit margin, investment payback period and market threshold of each model.

Policy Support: Investment Incentives and Trade Facilitation

This section interprets the investment incentive policies in detail: preferential treatments for Class A-D enterprises stipulated in the Investment Law (investment amount ranging from 1 million to 2 billion CFA francs, tax exemption rate of 25%-50%), an additional 3-year preferential period for animal husbandry, exemption from real estate transfer tax, additional customs tax incentives for PPP models (20-40 years of concessionary operation), and special status for export-oriented enterprises (Class D enterprises with export volume ≥ 80%). It demonstrates facilitation measures such as 24-hour enterprise registration and national treatment for foreign investors.

04 Risks and Challenges

Infrastructure, Financing and Environmental Factors

Infrastructure Bottlenecks: Cold Chain Logistics and Power Supply

This section identifies the core infrastructure challenges: cold chain logistics (storage facilities as the weakest link, lack of refrigeration equipment in rural areas, long transportation distances), power costs (industrial electricity price of 140 CFA francs per kWh during peak hours, 75 CFA francs per kWh during normal hours, unstable power supply), and transportation networks (landlocked country, preferential policies only available beyond 50 kilometers from ports, seasonal impact on road conditions). Data is used to show the impact of infrastructure gaps on meat processing efficiency, loss rate and costs.

Financing Environment: High Costs and Strict Conditions

This section analyzes the financing challenges: financing channels (strict financing conditions of local banks, requiring collateral and financial review, high interest rates), foreign capital statistics (FDI inflow of USD 149 million in 2020, stock of USD 3.02 billion, mainly from France/Lebanon/Libya accounting for 70%), and financing recommendations (international financing is recommended, local financing has high risks and difficult operation, the government has set up a 100 billion CFA franc fund to support distressed enterprises with an annual interest rate below 4%). It compares the financing advantages of French and Lebanese investors in Burkina Faso.

Market and Operational Risks: Price Fluctuations and Safety Management

This section identifies operational risks: market prices (low prices for farmers, high profits for middlemen, disconnect between domestic and international prices), seasonality (thin animals and low prices from February to May, high festival demand from December to January), security factors (impact of terrorism in the northern/eastern border areas, need to establish emergency plans, avoid traveling alone during the day), disease risks (foot-and-mouth disease, weak epidemic prevention and control system), and climate change (drought in the Sahel region, seasonal feed shortage).

05 Strategic Recommendations

Market Access Paths and Partner Selection

Market Entry Strategies: From Joint Ventures to Greenfield Investment

This section proposes three types of entry strategies: joint venture model (joint venture with local large-scale farmers/traders, utilizing existing market networks, reducing cultural/language barriers, suitable for initial entry), merger and acquisition model (acquiring local slaughterhouses or meat processing plants, quickly obtaining production capacity and licenses, suitable for those with local experience), and greenfield investment model (building new modern facilities, applying for Class A-D investment incentives, suitable for long-term strategic investors). It analyzes the advantages, disadvantages, investment scale and applicable scenarios of each model.

Partner Selection: From Government to Private Sector

This section identifies key partners: government departments (Ministry of Animal Husbandry and Fisheries, Investment Promotion Agency API-BF, Enterprise Registration Center CEFORE), international organizations (World Bank IDA, African Development Bank AfDB, West African Economic and Monetary Union), private sector (local large-scale farmer cooperatives, livestock market operators, meat wholesalers/retailers, cold chain logistics service providers), and financial institutions (local banks, international development funds, Islamic Development Bank). It provides screening criteria and cooperation recommendations.

Implementation Path: From Pilot Project to Scaling Up

This section formulates a phased implementation path: Phase 1 – Pilot Period (1-2 years, selecting pilot areas around Ouagadougou/Bobo-Dioulasso, building/leasing slaughterhouses, establishing local supply chains, obtaining halal certification); Phase 2 – Expansion Period (3-5 years, replicating successful models to other regions, building cold chain logistics networks, developing export markets, establishing brands); Phase 3 – Scaling Up Period (more than 5 years, vertically integrating the industrial chain, achieving regional market leadership, exploring high-value-added products such as leather/dairy products).

Financial Forecast: Investment Return and Profit Model

This section constructs a financial model: investment scale (slaughterhouse construction: USD 1-5 million, cold chain logistics: USD 0.5-2 million, operating capital: USD 1-3 million), revenue structure (slaughtering service fees, meat sales, by-products, export profits), cost structure (cattle procurement: 60-70%, labor: 5-10%, energy: 5-8%, transportation: 5-10%, others: 10-15%), profit forecast (gross profit margin: 15-25%, investment payback period: 5-7 years, ROI: 15-20%). It provides sensitivity analysis and scenario assumptions.

Seize the Historic Opportunity of Agricultural and Animal Husbandry Transformation and Upgrading in West Africa

Conclusion

The animal husbandry and slaughtering industry in Burkina Faso is at a critical juncture of transformation from tradition to modernization. The influx of international capital, domestic policy support, and the growth of regional market demand together constitute an unprecedented investment window. For visionary investors, now is the best time to lay out the agricultural and animal husbandry value chain in West Africa and seize the first-mover advantage.